By James Van Straten (All times ET unless indicated otherwise)

Bitcoin (BTC) bulls still seem to be in control. The largest cryptocurrency posted a record-high daily close on Tuesday, at $106,830, as it extends its strong upward momentum with minimal pullbacks, putting the previous all-time high of just over $109,000 from Jan. 20 well within reach.

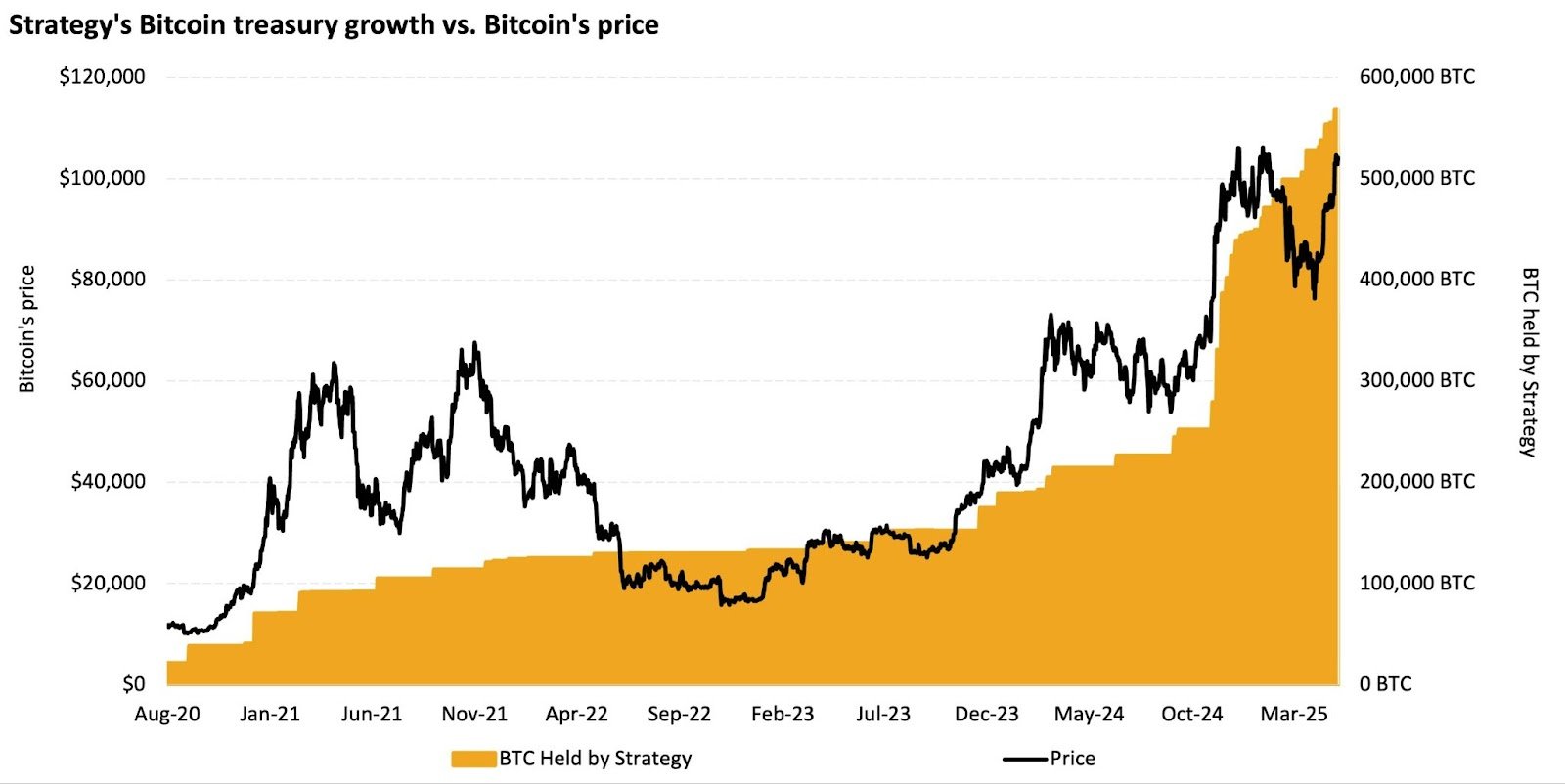

This price action has significantly boosted bitcoin-leveraged equities, with Japan’s MetaPlanet (3350) standing out—its stock has surged 160% in 2025 alone. Strategy (MSTR), the poster boy for bitcoin buying, has added 44%.

MetaPlanet has repeatedly hit Japan’s daily limit-up threshold within minutes of market open, effectively freezing upward trading for the day and fueling what resembles a slow-motion short squeeze.

Speculation around MetaPlanet’s aggressive bitcoin accumulation, as indicated by metrics like Days to Cover mNAV, is driving investor frenzy. Still, CEO Simon Gerovich recently posted on X that MetaPlanet is now the most shorted stock in Japan, with 25% of outstanding shares held short.

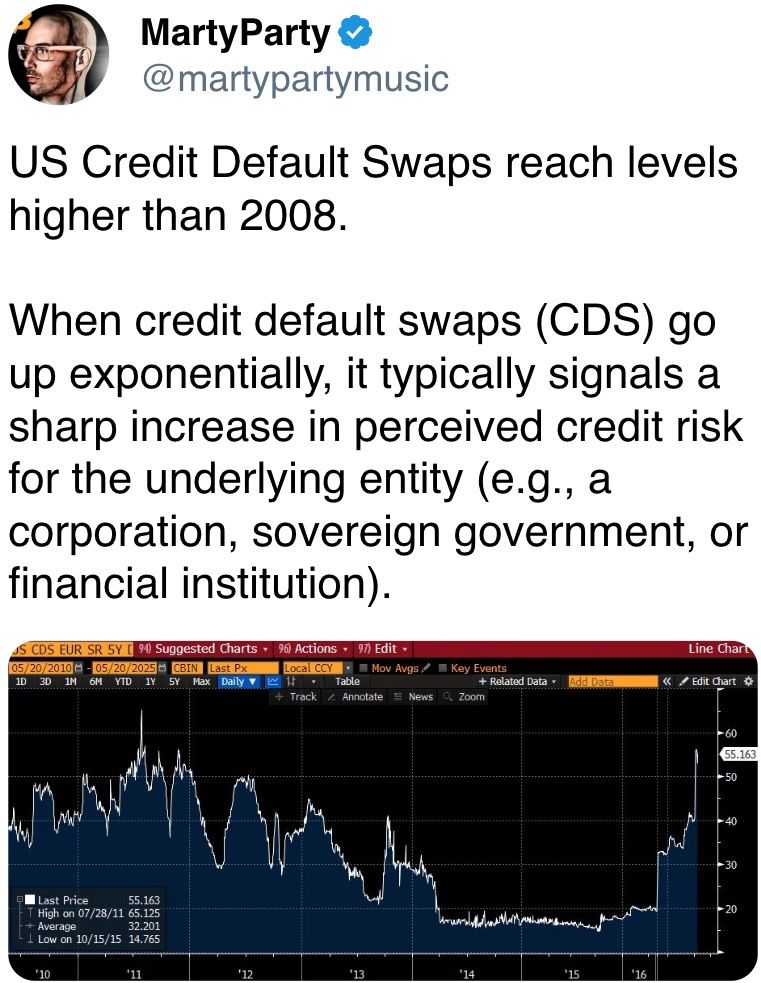

Meanwhile, macroeconomic conditions add to the complexity.

Japanese bond yields are spiking, with the 30-year yield climbing above 3.1% and the 10-year surpassing 1.5% — the highest since 2008. In the U.K., inflation unexpectedly climbed to a 15-month high, pushing the 10-year gilt yield toward the critical 5% level.

With bitcoin nearing new highs amid rising global yields and persistent inflationary pressures, markets are entering a phase of heightened volatility that demands keen attention. Stay alert!

What to Watch

- Crypto

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by President Trump at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- Day 2 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

- May 21, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Est. 0.1% vs. Prev. 0.2%

- Retail Sales YoY Est. 2.2% vs. Prev. -1.1%

- May 22, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

- GDP Growth Rate QoQ Est. 0.2% vs. Prev. -0.6%

- GDP Growth Rate YoY Est. 0.8% vs. Prev. 0.5%

- May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

- PPI MoM Est. -0.5% vs. Prev. 0.5%.

- PPI YoY Prev. 4.7%.

- May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

- Initial Jobless Claims Est. 230K vs. Prev. 229K

- Earnings (Estimates based on FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40, “Callisto.” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends May 29.

- May 21, 11 a.m: Maple to host an X spaces session to “unveil the next chapter of Maple.”

- May 22: Official Trump to announce its “next Era” at the day of the dinner for the largest token holders.

- June 10: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $22.58 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $169.38 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.33 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $15.36 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.91 million.

- Token Launches

- May 21: Mantra (OM) to be listed on Upbeat and the Crypto.com app.

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

- Day 3 of 7: Dutch Blockchain Week (Amsterdam)

- Day 2 of 3: Avalanche Summit London

- Day 2 of 3: Seamless Middle East Fintech 2025 (Dubai)

- Day 1 of 2: Crypto Expo Dubai

- Day 1 of 2: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa and Oliver Knight

- Hailey Welch, aka “Hawk Tuah Girl,” is distancing herself from the failed HAWK memecoin she promoted in December 2024, despite initially calling it a compliant, fan-focused project.

- On her Talk Tuah podcast, Welch said she was questioned by the FBI, gave her phone to the SEC, and was “cleared” of wrongdoing, claiming she was an unwitting participant.

- Welch now says she didn’t understand crypto and felt “sick” that fans trusted her, contrasting her November 2024 enthusiasm, when she claimed to have “learned so much” about the token.

- HAWK, launched on Solana, reached a $491 million market cap before crashing below $100 million within hours. It’s now at $104,000, down 99% from its peak.

- Welch claimed user losses were $180,000, much lower than the estimated $1.2 million. Her figure excludes 10,149 token holders who never sold, per Solscan.

- Commentators criticized Welch for endorsing a project she didn’t understand, with YouTube comments highlighting her lack of accountability.

- Welch’s team previously stated the project was legally compliant with a Cayman foundation and that her tokens would vest over three years.

Derivatives Positioning

- BTC CME futures open interest continues to rise, topping $17 billion for the first time since February. Meanwhile, growth in ETH open interest has stalled above $2 billion. However, the premium in ETH futures is slightly higher than BTC's.

- On offshore exchanges, perpetual funding rates continue to flash bullish with sub-10% readings.

- BCH, TON perpetual funding rates remain negative, suggesting a bias for shorts and potential for a short squeeze should the market move higher.

- In options, flows on OTC network Paradigm featured demand for calls, especially the $180K call expiring in September.

Market Movements

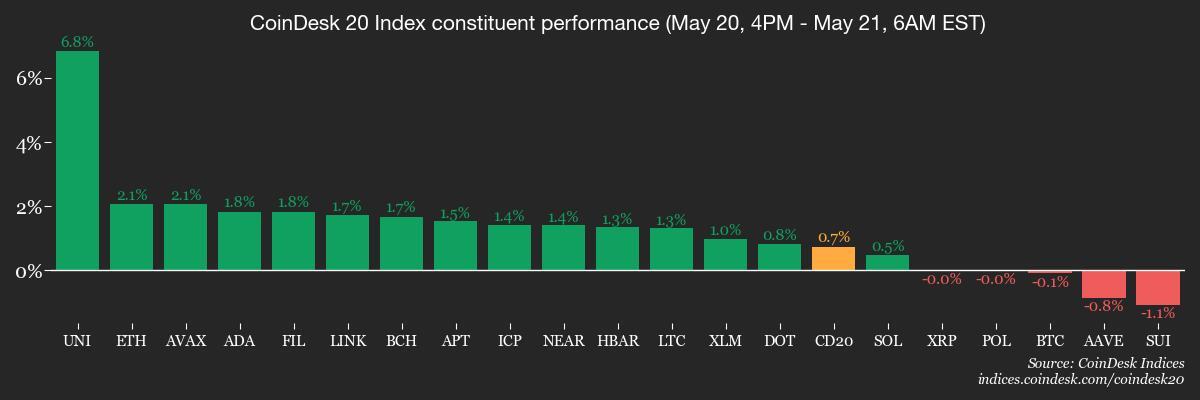

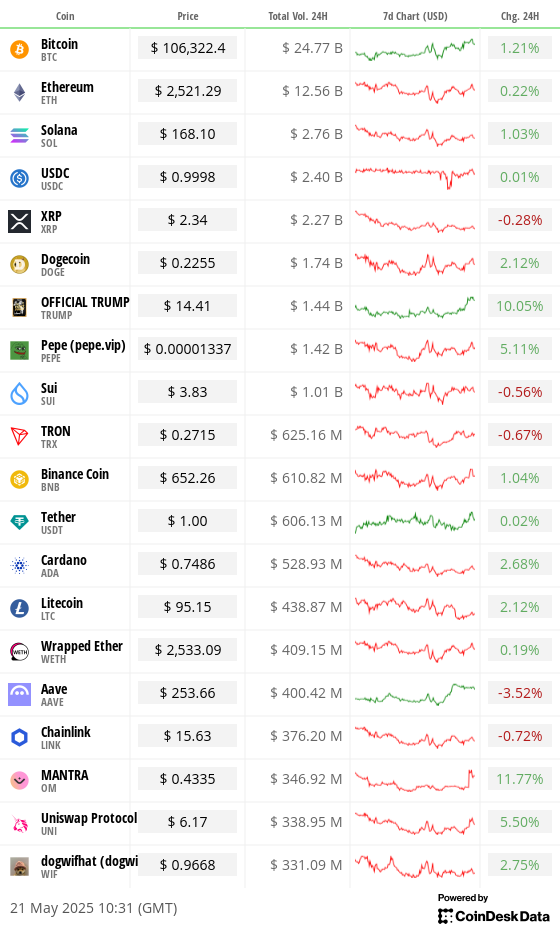

- BTC is down 0.64% from 4 p.m. ET Tuesday at $106,257.16 (24hrs: +1.23%)

- ETH is up 0.42% at $2,525.16 (24hrs: +0.51%)

- CoinDesk 20 is down 0.27% at 2,268.01 (24hrs: +0.6%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.03%

- BTC funding rate is at 0.0088% (9.6886% annualized) on Binance

- DXY is down 0.49% at 99.63

- Gold is up 1% at $3,313.10/oz

- Silver is up 1.02% at $33.31/oz

- Nikkei 225 closed -0.61% at 37,298.98

- Hang Seng closed +0.62% at 23,827.78

- FTSE is down 0.15% at 8,768.01

- Euro Stoxx 50 is down 0.45% at 5,430.16

- DJIA closed on Tuesday -0.27% at 42,677.24

- S&P 500 closed -0.39% at 5,940.46

- Nasdaq closed -0.38% at 19,142.71

- S&P/TSX Composite Index closed +0.32% at 26,055.6

- S&P 40 Latin America closed -0.26% at 2,631.81

- U.S. 10-year Treasury rate is up 5 bps at 4.54%

- E-mini S&P 500 futures are down 0.76% at 5,914.75

- E-mini Nasdaq-100 futures are down 0.81% at 21,274.50

- E-mini Dow Jones Industrial Average Index futures are down 0.76% at 42,447.00

Bitcoin Stats

- BTC Dominance: 64.01 (-0.15%)

- Ethereum to bitcoin ratio: 0.02378 (0.63%)

- Hashrate (seven-day moving average): 884 EH/s

- Hashprice (spot): $56.1

- Total Fees: 7.42 BTC / $784,400

- CME Futures Open Interest: 160,155

- BTC priced in gold: 32.3 oz

- BTC vs gold market cap: 9.15%

Technical Analysis

- BTC rose as high as $108,000 early today but struggled to maintain the momentum, with the hourly chart MACD histogram turning negative.

- Prices will likely consolidate for some time, allowing a positive reset of the MACD, following which the next leg higher could resume.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $416.92 (+0.85%), down 0.58% at $414.50 in pre-market

- Coinbase Global (COIN): closed at $261.38 (-0.99%), down 0.67% at $259.64

- Galaxy Digital Holdings (GLXY): closed at C$30.52 (-3.08%)

- MARA Holdings (MARA): closed at $16.19 (-0.8%), down 1.17% at $16

- Riot Platforms (RIOT): closed at $8.93 (-0.45%), down 1.46% at $8.80

- Core Scientific (CORZ): closed at $10.92 (+0.65%), down 2.2% at $10.68

- CleanSpark (CLSK): closed at $9.7 (-1.42%), down 1.65% at $9.54

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.99 (-0.77%)

- Semler Scientific (SMLR): closed at $41.88 (-3.21%), up 2.63% at $42.98

- Exodus Movement (EXOD): closed at $34.51 (+1.77%), down 1.45% at $34.01

ETF Flows

Spot BTC ETFs:

- Daily net flow: $329.2 million

- Cumulative net flows: $42.75 billion

- Total BTC holdings ~ 1.19 million

Spot ETH ETFs

- Daily net flow: $64.8 million

- Cumulative net flows: $2.61 billion

- Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Strategy (MSTR) has been accumulating bitcoin at a breakneck speed, maintaining the pace even during the March-April price swoon.

- "From GameStop to MetaPlanet to Strategy’s $60B stash, BTC is reshaping corporate finance. Discover how the '42/42 Plan' could become a blueprint for others," 21Shares said on X.

While You Were Sleeping

- Bitcoin Sets Record Daily Close With $110K as the Next Level to Watch for BTC (CoinDesk): Bitcoin set a record high close on Tuesday at $106,830 as spot ETF inflows rose and bond-market turmoil fueled concerns over fiscal stability, which analysts say could benefit BTC and gold.

- SEC Charges Unicoin, Top Executives With $100M ‘Massive Securities Fraud’ (CoinDesk): The SEC alleged Unicoin misled investors by inflating property values, overstating sales claims — touting $3 billion when only $110 million was raised — and promoting rights certificates with exaggerated return promises.

- U.K. Inflation Jumps, Reinforcing Bank of England’s Caution (The Wall Street Journal): Annual inflation rose more than forecast to 3.5% in April on rising labor and energy costs. Projections suggest a gradual return to target by 2027.

- 'Days to Cover mNAV': The New Standard for Evaluating Bitcoin Equities (CoinDesk): This metric estimates how long a company would need to accumulate enough bitcoin to justify its market cap based on daily yield and net asset value multiple.

- Morgan Stanley Strategists Say Buy America Except the Dollar (Bloomberg): Morgan Stanley strategists expect 2026 Fed rate cuts to benefit U.S. stocks and Treasuries, while forecasting dollar weakness as growth and yield advantages over other economies shrink.

- IMF Urges U.S. to Curb Deficit as Trump Tax Cut Plan Stirs Debt Fears (Financial Times): The IMF’s first deputy managing director said U.S. fiscal policy should aim to lower the debt-to-GDP ratio and warned that trade uncertainty remains high despite recent tariff relief.

In the Ether

1 month ago

59

1 month ago

59

English (US) ·

English (US) ·