By James Van Straten (All times ET unless indicated otherwise)

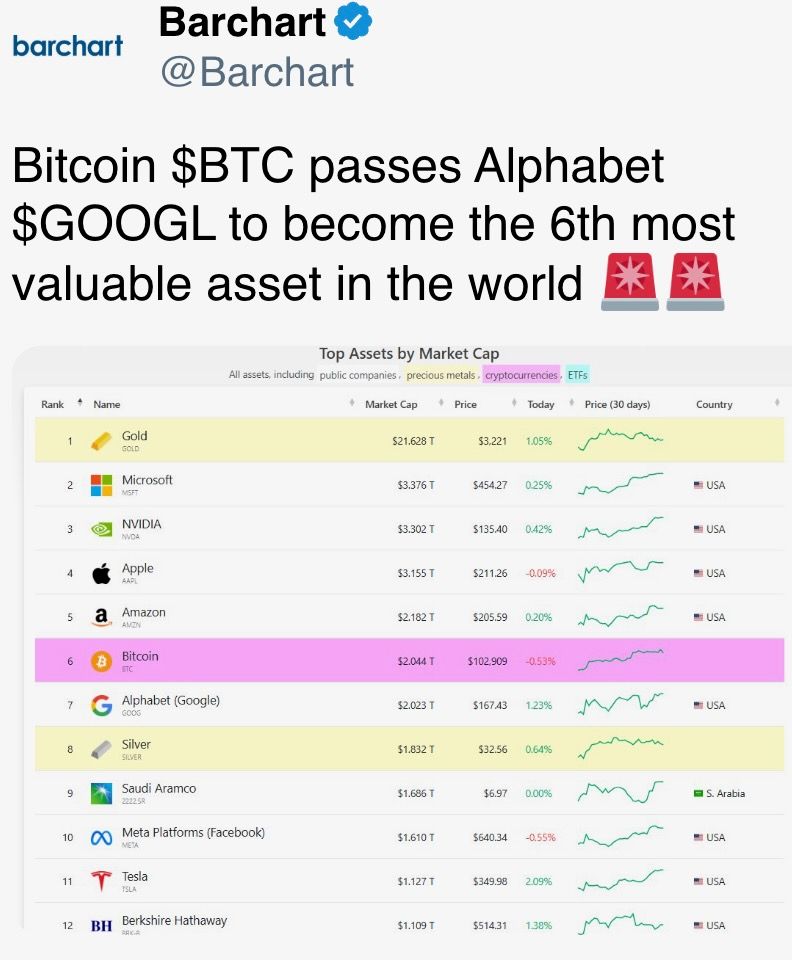

Bitcoin BTC started the week on a positive note, rising above $107,000 — the highest since Jan. 24, according to CoinDesk data —before pulling back to $102,000 during the Asian morning.

Despite the retracement, the largest cryptocurrency continues to trend upward, forming higher highs and higher lows within an ascending consolidation channel, while its market dominance rose above 64%.

There's a bullish bias in the options market, too. Deribit data shows a heavy concentration of call open interest above $100,000, particularly at the $110,000, $115,000 and $120,000 strike prices for May 30, when $8 billion in notional value expires. Call options, which give holders the right to buy BTC at a specific price, are typically used to bet that the price will rise to or above that level.

Another sign of strong demand comes from Glassnode data showing widespread accumulation across all wallet cohorts from holders of less than 1 BTC to over 10,000 BTC. The accumulation trend score rose to 0.87; the maximum value is 1.

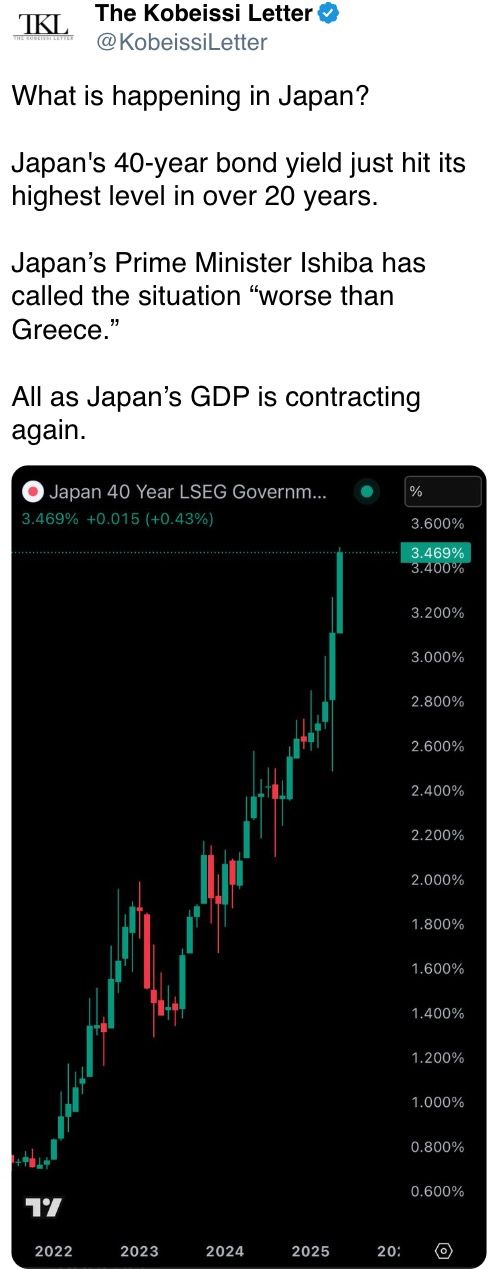

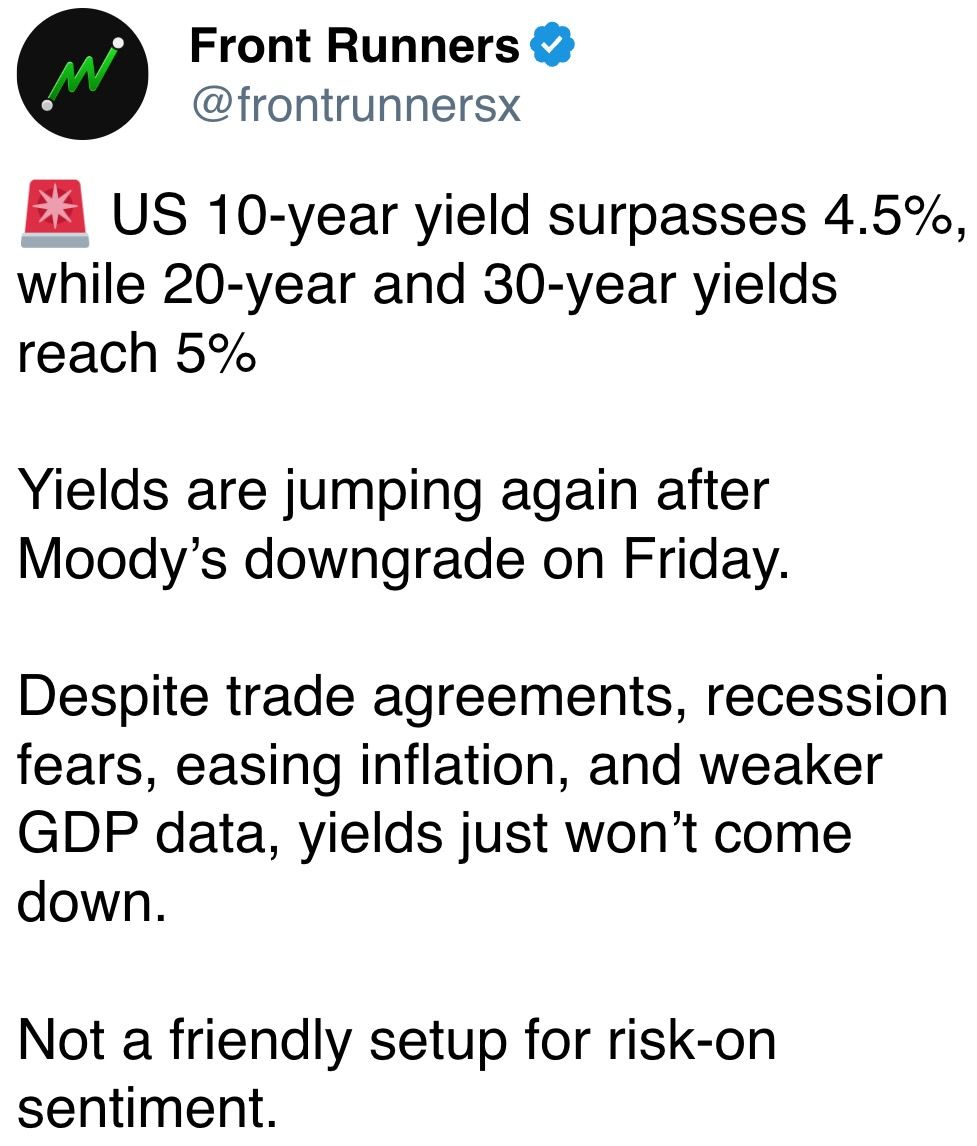

For a note of caution, take a look at the U.S. 30-year Treasury yield, which topped 5% as Moody’s Ratings downgraded the debt to Aa1 from Aaa, citing fiscal concerns in the U.S. The last time the yield rose that high, April 9, bitcoin dropped to a monthly low of $75,000.

Meanwhile, the U.K. overtook China as the second-largest holder of U.S. debt, and Tether’s U.S. Treasury holdings are poised to surpass Germany’s, potentially placing it among the top 20 foreign holders. At a time when the U.S. is actively seeking buyers for its bonds, none may be more critical than the issuer of the largest stablecoin. Stay alert!

What to Watch

- Crypto

- May 19: CME Group will launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by President Trump at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- May 19: U.K. Prime Minister Keir Starmer meets European Council President António Costa and European Commission President Ursula von der Leyen in London for the first post-Brexit U.K.-EU summit, which should result in the signing of a landmark defense and security treaty and a joint statement pledging deeper economic cooperation.

- May 19, 10 a.m.: President Donald Trump is scheduled to call Russian President Vladimir Putin to discuss a potential ceasefire in the Russia-Ukraine war. He will then call Ukrainian President Volodymyr Zelenskyy and various members of NATO.

- May 20-22: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

- May 20, 8:30 a.m.: Statistics Canada releases April consumer price inflation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Est. 0.5% vs. Prev. 0.3%

- Inflation Rate YoY Est. 1.6% vs. Prev. 2.3%

- Earnings (Estimates based on FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto”, bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17. Voting ends on May 29.

- May 20, 12 p.m.: Lido to hist its 28th node operator community call.

- May 21: Maple Finance teased an announcement on the future of asset management.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream

- May 22: Official Trump to announce its “next Era” at the day of the dinner for its largest holders.

- Unlocks

- May 19: Pyth Network (PYTH) to unlock 58.62% of its circulating supply worth $306.28 million.

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $21.6 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $161.9 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.31 million.

- Token Launches

- No major upcoming token listings.

Conferences

- Day 1 of 7: Dutch Blockchain Week (Amsterdam)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa

- Elon Musk revived his “Kekius Maximus” persona on X over the weekend, sending an associated memecoin up more than 100% after months of inactivity.

- Musk updated his profile picture to a gladiator-style depiction of himself and changed his display name.

- The Ethereum-based KEKIUS surged as followers noticed the change. Trading volumes for the token jumped to over $45 million, up from an average of $5 million in the past week, CoinGecko data shows.

- The 'Kekius' name is linked to existing frog-themed coins like pepe, featuring a frog dressed up as a Roman gladiator.

- It stems from the "Cult of Kek," a tongue-in-cheek internet phenomenon linking the term to an ancient Egyptian frog-headed deity of chaos and darkness.

- Ethereum-based PEPE, another frog-themed memecoin, surged 5%, with trading volume nearly tripling to $2.19 billion, making it the second-most traded memecoin after dogecoin (DOGE).

- The original Kekius Maximus rally occurred on New Year’s Eve 2024, when Musk first adopted the persona, sending the coin up 600% in a few days.

- The coin lost all gains after Musk dropped the avatar, but has since seen episodic spikes tied to his social media activity, as in March.

- The latest price movement underscores Musk’s continued outsized influence on speculative crypto markets, especially meme tokens, and how monitoring his account might open up short-lived profit (albeit highly risky) opportunities for micro-cap traders.

Derivatives Positioning

- Total open interest (OI) across all instruments on centralized exchanges remained relatively stable over the weekend, dipping slightly to $150 billion.

- Among assets with over $100 million in open interest, the biggest week-on-week gains were seen in PAXG, PEPE, TON and ALCH.

- The largest declines were observed in PNUT, POPCAT, BONK and SHIB.

- After sweeping key liquidation clusters at $106.5K and $102.8K, bitcoin is now trading around $103K.

- The next significant cluster of liquidations on the BTC-USDT pair on Binance sits at $107.5K, representing some $71.4 million in potential liquidations. On the downside, there's notable liquidation interest worth $52.7 million at $102.2K — a level that acted as support during today’s earlier reversal.

- Short-term hedging has intensified ahead of the May 23 and May 30 expiries, with puts dominating volume (~$1.3B notional) and concentrated OTM exposure, signaling traders are bracing for near-term downside, according to data from Deribit.

- May 30 is the key expiry to watch, holding the largest OI (~$8 billion) on Deribit, skewed toward OTM calls and puts. This positioning suggests potential for sharp moves on spot price shifts around key strike levels.

Market Movements

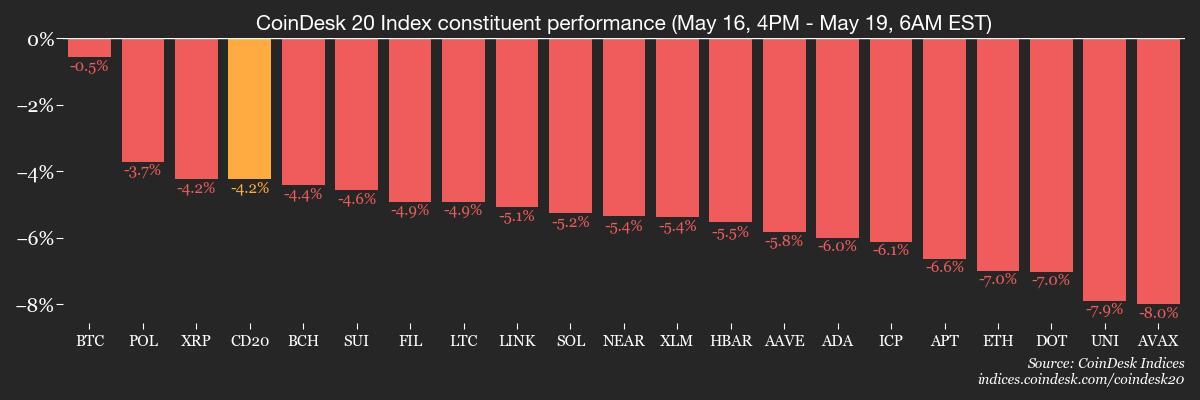

- BTC is down 0.78% from 4 p.m. ET Friday at $102,937.12 (24hrs: -0.74%)

- ETH is down 6.36% at $2,408.96 (24hrs: -3.89%)

- CoinDesk 20 is down 4.24% at 3,072.36 (24hrs: -3.33%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.91%

- BTC funding rate is at 0.0054% (5.9261% annualized) on Binance

- DXY is down 0.97% at 100.11

- Gold is up 1.04% at $3,237.26/oz

- Silver is up 0.71%% at $32.50/oz

- Nikkei 225 closed -0.68% at 37,498.63

- Hang Seng closed unchanged at 23,332.72

- FTSE is down 0.78%% at 8,616.91

- Euro Stoxx 50 is down 0.77% at 5,385.80

- DJIA closed on Friday +0.78% at 42,654.74

- S&P 500 closed +0.7% at 5,958.38

- Nasdaq closed +0.52% at 19,211.10

- S&P/TSX Composite Index closed +0.29% at 25,971.93

- S&P 40 Latin America closed -0.28% at 2,623.99

- U.S. 10-year Treasury rate is up 7 bps at 4.55%

- E-mini S&P 500 futures are down 1.33% at 5,896.25

- E-mini Nasdaq-100 futures are down 1.72% at 21,135.25

- E-mini Dow Jones Industrial Average Index futures are down 0.84% at 42,375.00

Bitcoin Stats

- BTC Dominance: 64.01 (0.26%)

- Ethereum to bitcoin ratio: 0.02327 (-0.85%)

- Hashrate (seven-day moving average): 855 EH/s

- Hashprice (spot): $54.44

- Total Fees: 5.92 BTC / $617,813

- CME Futures Open Interest: 149,515 BTC

- BTC priced in gold: 31.9 oz

- BTC vs gold market cap: 9.03%

Technical Analysis

- After recording the highest ever weekly close, bitcoin has retraced to the lower end of its current range at $102,800.

- Last week, each dip below this level was met with strong buying interest, highlighting continued demand.

- While the weekly close signals bullish momentum, it's worth noting that bitcoin has rallied from its April lows without a meaningful pullback, printing six consecutive green weekly candles.

- Should the range lows break, a deeper move toward the weekly order block between $94,000 and $99,000 becomes likely. This zone also aligns with key technical confluences, including the 50-day exponential moving average and the previous monthly high.

- Today’s price action is shaping a typical Monday range setup, and a reclaim of Monday’s low in the coming days could serve as a catalyst for further upside.

Crypto Equities

- Strategy (MSTR): closed on Friday at $399.80 (+0.7%), down 1.32% at $394.52 in pre-market

- Coinbase Global (COIN): closed at $266.46 (+9.01%), down 2.8% at $259

- Galaxy Digital Holdings (GLXY): closed at C$31.49 (+3.01%)

- MARA Holdings (MARA): closed at $16.21 (+3.38%), down 1.97% at $15.89

- Riot Platforms (RIOT): closed at $9.15(+5.17%), down 1.97% at $8.97

- Core Scientific (CORZ): closed at $10.78 (+2.57%), down 3.15% at $10.44

- CleanSpark (CLSK): closed at $9.78 (+4.49%), down 2.56% at $9.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18 (+8.63%)

- Semler Scientific (SMLR): closed at $40.88 (+28.59%), down 4.35% at $39.10

- Exodus Movement (EXOD): closed at $35.40 (-1.01%), down 1.13% at $35

ETF Flows

Spot BTC ETFs:

- Daily net flow: $260.2 million

- Cumulative net flows: $41.74 billion

- Total BTC holdings ~ 1.18 million

Spot ETH ETFs

- Daily net flow: $22.2 million

- Cumulative net flows: $2.53 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

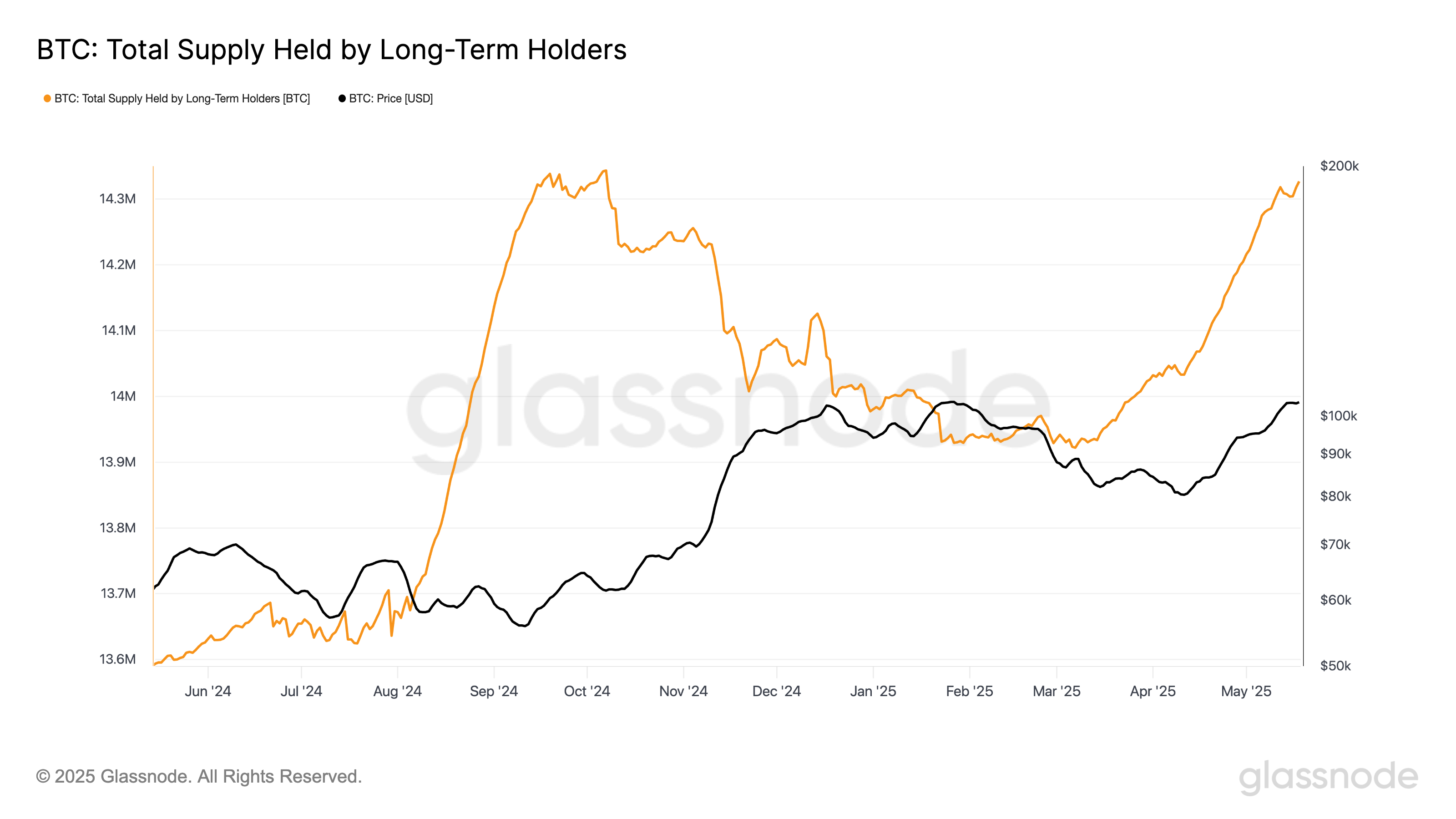

- Bitcoin long-term holder supply is approaching a one-year high of 14,326,823 BTC.

- That's an increase of 400,000 BTC from this year’s lows as long-term holders show growing conviction in price increases.

While You Were Sleeping

- ‘Sell America’ Is Back as Moody’s Pushes 30-Year Yield to 5% (Bloomberg): Moody’s downgrade over America’s budget deficit sparked Max Gokhman’s warning that shifting from Treasuries could lift yields and curb demand for the dollar and U.S. stocks.

- China’s Economy Feels the Sting From Trade War (The Wall Street Journal): April data showed weakening industrial output, spending and investment as tariff uncertainty weighed on growth and analysts urged stronger stimulus to meet official targets.

- The Bull Case for Galaxy Digital Is AI Data Centers Not Bitcoin Mining, Research Firm Says (CoinDesk): Rittenhouse analysts say AI data-center operations generate stable, long-term cash flows with minimal capital needs, making them more attractive than the volatile, capital-intensive business of bitcoin mining.

- Russia Unleashes One of Its Largest Drone Barrages of the Ukraine War (The New York Times): Ukraine’s air defenses battled 273 drones over nine hours, mostly near Kyiv, where a woman was killed and several others, including a child, were wounded.

- Metaplanet Buys Another 1,004 Bitcoin, Lifts Holdings to Over $800M Worth of BTC (CoinDesk): The Tokyo-based investment firm added to its bitcoin position at an average price of $103,873 per BTC.

- Ripple Signs Two More Payment System Customers in UAE Expansion (CoinDesk): Ripple signed UAE-based Zand Bank and Mamo to its cross-border payments platform after securing a license from the Dubai Financial Services Authority in March.

In the Ether

2 months ago

57

2 months ago

57

English (US) ·

English (US) ·