It’s hard to believe that ETH was languishing at less than $1500 in April. Now it’s above $3800 again.

Ethereum’s comeback is the story of the summer. Through ETFs ($2 billion inflows in two weeks), ETH treasury vehicles and excitement around tokenization, the comeback is well and truly on. And institutions are in the driving seat.

One of BlackRock’s key digital assets stars will lead Joseph Lubin’s ETH vehicle, SharpLink.

As EY’s Paul Brody wrote this week, with institutions, “Ethereum Has Already Won,” and will probably keep winning for decades to come. The incumbency of the Network Effect – that a critical mass of transactions in stablecoins and tokenization will fall to Ethereum – makes it a de facto network.

We’ll see.

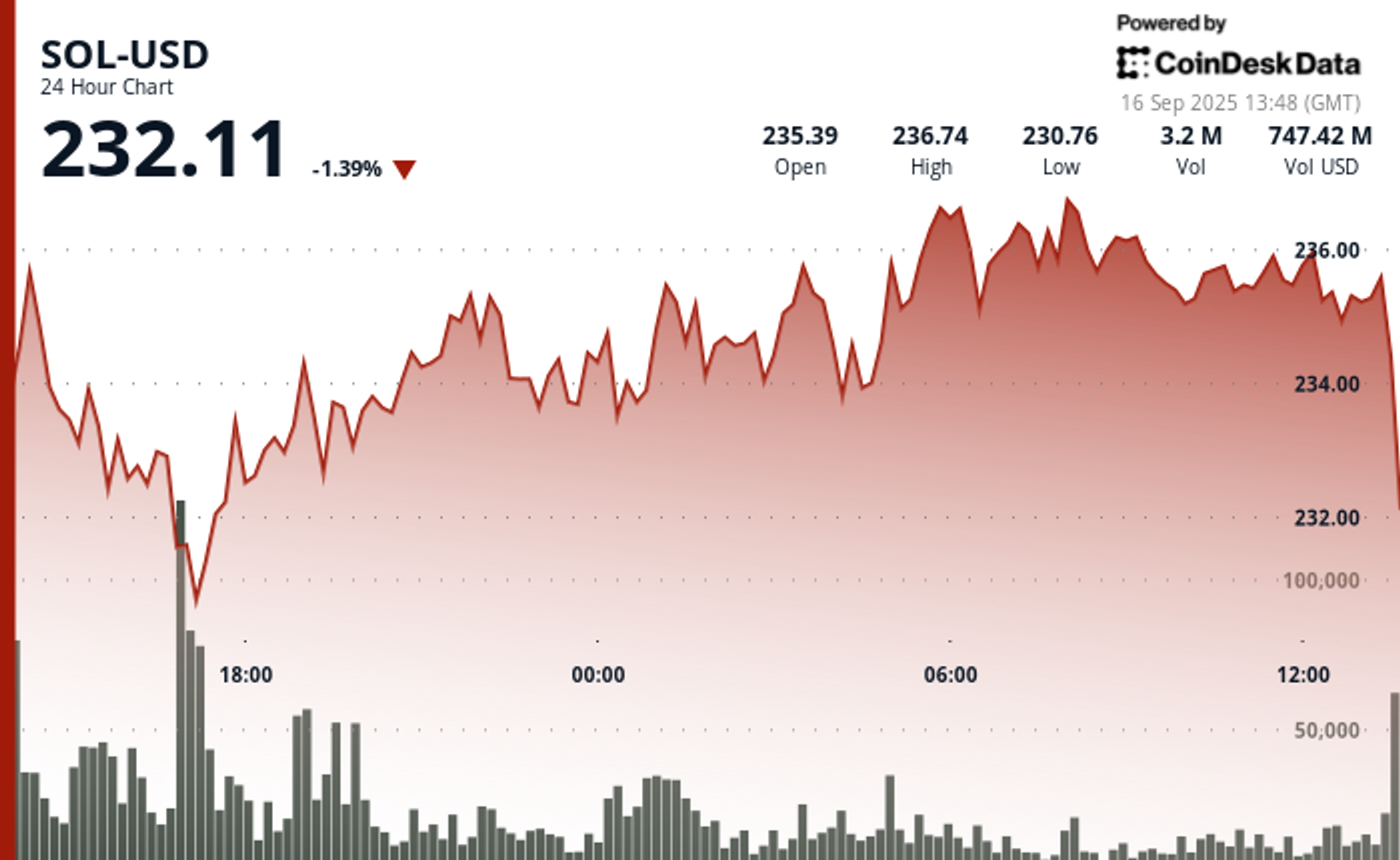

In markets:

While bitcoin held steady under 120k, altcoins did well. Hell. Most of the crypto market is looking relatively healthy these days.

And, according to President Trump, Jerome Powell could soon cut rates (or get fired). If so, that will help risky assets like bitcoin et al.

In other big news:

Roman Storm’s Tornado Cash trial intensified. CoinDesk’s Cheyenne Ligon was there.

Elon signed up X/Grok to prediction market Kalshi

JP Morgan will offer crypto loans but faces protests from crypto trade groups over data access.

See you next week.

1 month ago

76

1 month ago

76

English (US) ·

English (US) ·